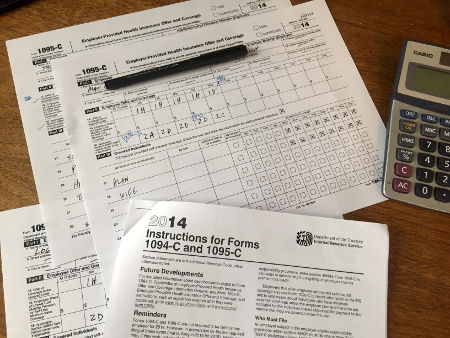

ACA reporting is a new IRS requirement – and you have to comply!

Under the Patient Protection and Affordable Care Act (ACA), individuals are required to have health insurance while applicable large employers (ALEs) are required to offer health benefits to their full-time employees. In order for the Internal Revenue Service (IRS) to verify that (1) individuals have the required minimum essential coverage, (2) individuals who request premium tax credits are entitled to them, and (3) ALEs are meeting their shared responsibility obligations, employers with 50 or more full-time or full-time equivalent employees and insurers will be required to report on the health coverage they offer.

InTech can help any employer or multiemployer organization – big or small. Fully insured or self-insured, InTech knows what information is needed and how to report it. Utilizing your payroll and benefits information, InTech can convert the information to the required reporting format. Or, if your data is retained in two different systems, InTech can aggregate payroll and benefits data to complete the 1094 or 1095 employee and employer forms as required. As you know, the IRS is an organization to comply with completely so let InTech handle the reporting process so you don’t have to worry about the reporting complexity and possible fines.